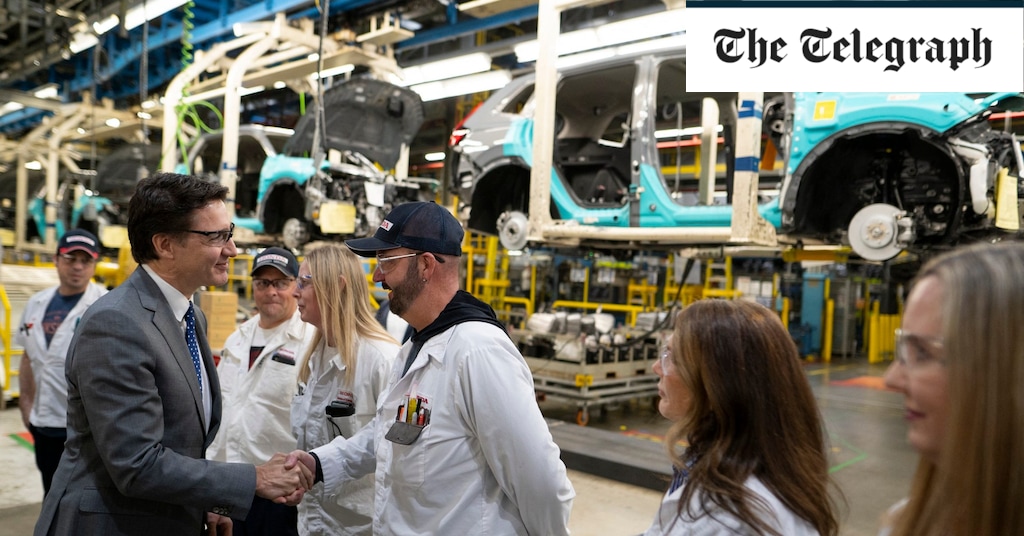

The authors of the study said the figures should serve as a ‘wake-up call’ for the country’s Liberal government

Out of the many repost of this story since Friday this is most wild claim I’ve seen. It’s on r/Canada level of ignorance.

The authors of the study by the non-partisan Fraser Institute

I’ve also never seen something with that many citation on Wikipedia.

Of course they’re registered as charity… so they can avoid paying tax…

What do they give to the community of there a charity?

It seems they missed the air-quotes around “non-partisan”. So easy; see?

The exact same situation is happening in most (if not all) first world countries, regardless of if their government is left or right leaning.

The effects are global, so national policy is going to have only small effects upon the greater trends.

This is very true. This century we are pretty much hitting the limits of growth and globally the response has been to hit the accelerator.

Pretty much every country fired up their money printers to power through covid.

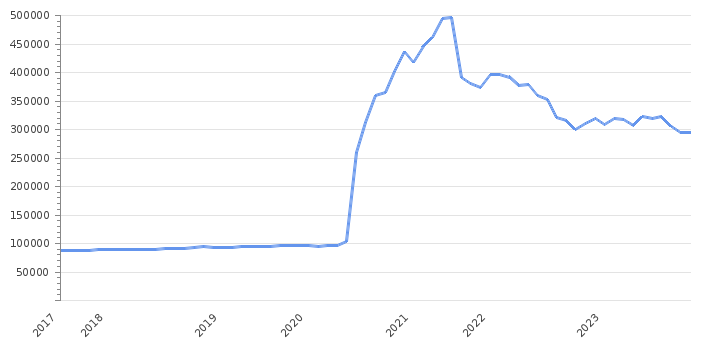

Here is Canada’s money supply:

Every other country did the same thing. Although I think governments, companies, and individuals are stumbling through the shock of such an unprecedented injection of supply… Ultimately IMO this is a global “hangover” from covid money printing.

This is why I’m hesitant to over-attribute current economic conditions to things like “approaching limits of growth”. To me, those are zebras. Unprecedented monetary supply manipulation are horses. When I hear hoofbeats, my first guess is the horses.

Oh sure for current inflation but everything post 2000 is a house of cards. stock prices completely deviated from earnings as they turned into value holds and income was pulled out via debt.

deleted by creator

Ok I’ll bite. How does Canadian policy cause global inflation?

The only angle that I can think of is that we’ve had a larger impact on carbon production than most other countries, and at least when it comes to global food inflation, climate change is having a noticable impact. So one might be able to argue that our role in climate change is causing food inflation. But I doubt anyone has actually done any peer reviewed studies on that so it’s likely just assumptions at best.

I do think all levels of government have made some bad decisions that are unique to Canada, but yes they are. Our housing crisis is probably the worst example.

With an argument that compelling how can I not be convinced! /s

Why does the Telegraph give a rats ass about Canadian standard of living? They should be more concerned about the UK standard of living that has gone into crap hole since the Tories have been in office.

deleted by creator

Perhaps they want to distract people from conditions in the UK.

Don’t give me Standard of Living; give me Quality of Life.

Interesting they’re blaming the Liberals when this decline’s been going on for at last two decades now, at least relative to global wealth. Frankly, I wouldn’t be surprised to see that relative standard of living compared to the rest of the world, we’ve been declining the entire 40 years on average.

And looking at the trends, we’re headed right towards another recession on top of a housing bubble burst, so no matter what anybody tries, we’re looking at another decade of decline before there’s even a chance of things getting better. The moment the housing bubble crashes, we’re looking at a similar situation to Japan’s lost decades, and we can only hope to ride it out half as well as they have.